The Ultimate Startup Data Room Checklist: What to Include in 2025

Preparing for investor due diligence can be overwhelming. Many founders struggle with what documents to include, how to organize them, and how to share them securely. In fact, a poorly organized data room can delay fundraising or even kill a deal entirely.

This comprehensive checklist will help you build a professional-grade data room that impresses investors and streamlines your fundraising process.

Complete Startup Data Room Checklist

Here's a comprehensive checklist of documents to include in your startup data room:

| Category | Documents | Priority |

|---|---|---|

| Company Overview | Pitch Deck, Executive Summary, Business Plan | High |

| Financial Documents | P&L Statements, Financial Projections, Cap Table | High |

| Legal Documents | Incorporation, Bylaws, Shareholder Agreements | High |

| Team | Employee Contracts, Org Chart, Key Personnel Bios | Medium |

| Intellectual Property | Patents, Trademarks, IP Strategy | High |

| Market & Traction | Market Analysis, Customer Metrics, Sales Pipeline | Medium |

| Product | Product Roadmap, Technical Documentation, Demo Videos | Medium |

| Previous Funding | Investment Agreements, SAFE Notes, Convertible Notes | High |

Detailed Breakdown of Each Category

1. Company Overview

The foundation of your data room should be a clear and compelling company overview that helps investors quickly understand your business:

- Pitch deck (latest version)

- One-pager executive summary

- Business plan

- Company mission and vision

- Corporate structure diagram

2. Financial Documents

Investors need a comprehensive view of your financial health and future projections to evaluate the investment opportunity:

- Income statements

- Balance sheets

- Cash flow statements

- Financial projections (3-5 years)

- Cap table

- Burn rate and runway calculations

- Previous fundraising history

3. Legal Documents

Demonstrate your company's legal compliance and corporate governance with these essential documents:

- Articles of incorporation

- Bylaws

- Board meeting minutes

- Shareholder agreements

- Material contracts

- Regulatory approvals (if applicable)

4. Team Information

Showcase the strength and experience of your team, as investors often say they invest in people first:

- Organizational chart

- Employee agreements

- Consultant contracts

- Team bios

- Hiring plan

- Option pool details

5. Intellectual Property

Protect and highlight your company's competitive advantages and proprietary technology:

- Patent applications and grants

- Trademark registrations

- IP strategy document

- Software licenses

- Domain ownership proof

Example Startup Data Room Checklist

Here's a practical example of what a seed-stage SaaS startup might include in their data room:

| Priority Level | Document Type | Status |

|---|---|---|

| Priority 1 (Must-Have) | Latest pitch deck | ✅ |

| Priority 1 (Must-Have) | Cap table | ✅ |

| Priority 1 (Must-Have) | Financial model with 3-year projections | ✅ |

| Priority 1 (Must-Have) | Last 12 months of financial statements | ✅ |

| Priority 1 (Must-Have) | Certificate of incorporation | ✅ |

| Priority 1 (Must-Have) | Team overview with key hires timeline | ✅ |

| Priority 1 (Must-Have) | Product roadmap | ✅ |

| Priority 1 (Must-Have) | Customer metrics dashboard | ✅ |

| Priority 2 (Important) | Customer contracts (top 3-5) | ✅ |

| Priority 2 (Important) | Employment agreements for key team members | ✅ |

| Priority 2 (Important) | Technical architecture overview | ✅ |

| Priority 2 (Important) | Market size analysis | ✅ |

| Priority 2 (Important) | Competitor analysis | ✅ |

| Priority 2 (Important) | Customer testimonials/case studies | ✅ |

| Priority 3 (Nice-to-Have) | Board meeting minutes | ✅ |

| Priority 3 (Nice-to-Have) | Marketing strategy | ✅ |

| Priority 3 (Nice-to-Have) | Sales pipeline | ✅ |

| Priority 3 (Nice-to-Have) | Product demo videos | ✅ |

| Priority 3 (Nice-to-Have) | Press mentions | ✅ |

| Priority 3 (Nice-to-Have) | Previous investor updates | ✅ |

💡 Pro Tip: Start with Priority 1 documents and work your way down. Most investors will initially focus on these core documents anyway.

How to Organize and Secure Your Data Room

A well-organized and secure data room is crucial for successful fundraising. Here's how to structure and protect your documents effectively:

1. Document Organization

- Create Clear Categories: Use the categories from the checklist above

- Consistent Naming: Use clear, descriptive file names (e.g., "2024_Q1_Financial_Statements.pdf")

- Version Control: Include dates in file names for updated documents

- Index Document: Create a master document explaining the structure

- Progressive Disclosure: Organize documents in layers of sensitivity

2. Security and Access Control

- Email Verification: Require viewers to verify their email before access

- Access Levels: Structure folders based on document sensitivity:

- Level 1: Public information (pitch deck, company overview)

- Level 2: Basic confidential info (financial highlights, team bios)

- Level 3: Sensitive data (detailed financials, contracts)

- Viewer Permissions: Set different access levels for different stakeholders

- Time-Limited Access: Set expiration dates for document access

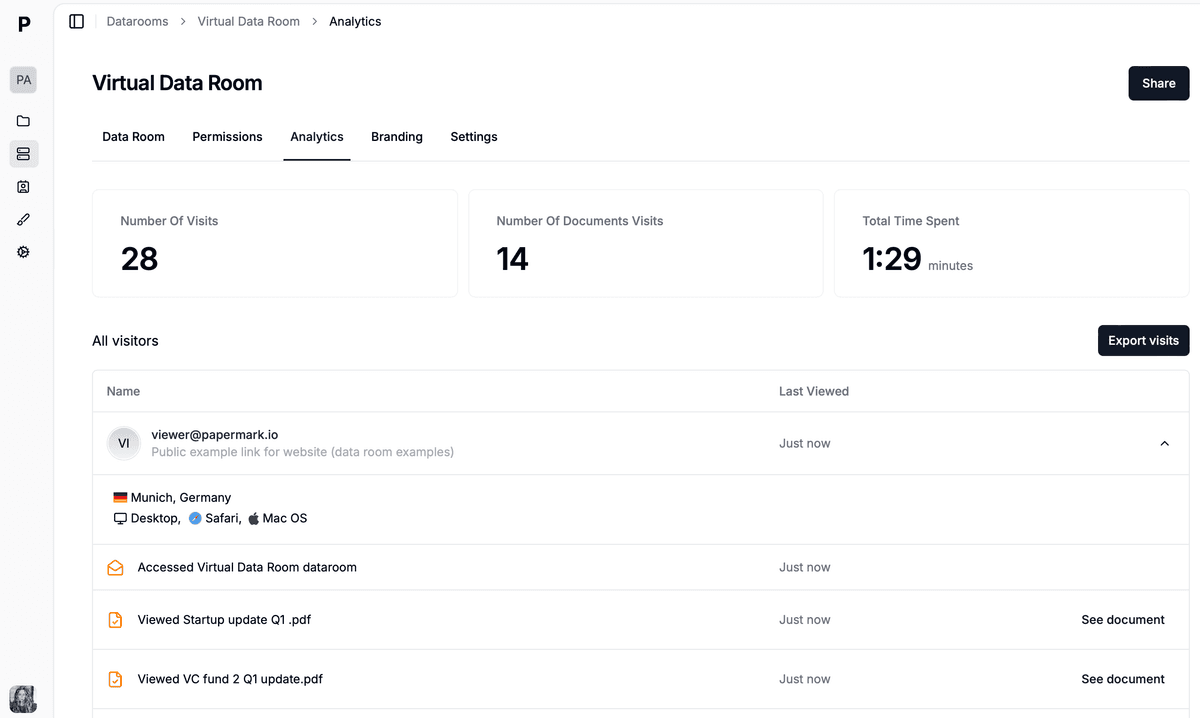

- Activity Tracking: Monitor who views what and when

3. Document Protection

- Watermarking: Add dynamic watermarks with viewer information

- Download Controls: Disable downloads for sensitive documents

- NDA Integration: Require NDA acceptance before accessing sensitive materials

- Password Protection: Add an extra layer of security for critical documents

Cost Considerations

Traditional virtual data rooms can be expensive, often charging:

- Per user

- Per document

- Per storage amount

- Per room

Papermark offers a more startup-friendly approach with:

- Flat pricing at €59/month (billed yearly)

- Unlimited data rooms

- Unlimited users

- Unlimited storage

- All security features included

Tips for Success

- Start Early: Begin organizing your data room before you need it

- Keep it Updated: Regularly review and update documents

- Quality Over Quantity: Focus on essential documents first

- Progressive Disclosure: Consider staging document access based on investor interest

- Track Engagement: Use analytics to understand investor interest

Conclusion

A well-organized data room is essential for startups seeking investment. It demonstrates professionalism, streamlines due diligence, and helps build investor confidence. With Papermark's secure and affordable solution, you can create a professional data room that impresses investors while protecting your sensitive information.

Get started with your secure data room today - try Papermark for free.