Venture Fund Data Room Checklist: Essential Documents for 2025

Creating a well-organized data room is crucial for venture funds seeking to streamline LP communication, accelerate due diligence, and demonstrate operational excellence.

This comprehensive guide provides a complete checklist of essential documents and best practices to help your fund build a professional, secure, and effective data room that impresses investors and enhances fundraising success.

Complete venture fund data room checklist

Here's a comprehensive checklist of documents to include in your venture fund data room:

| Category | Documents | Priority |

|---|---|---|

| Fund Overview | Fund Presentation, Executive Summary, Investment Thesis | High |

| Legal & Governance | LPA, PPM, Subscription Documents, Fund Formation Documents | High |

| Team Information | Partner Bios, Track Records, Team Structure | High |

| Financial Information | Fund Performance, Capital Account Statements, Financial Projections | High |

| Portfolio Companies | Portfolio Overview, Investment Memos, Valuation Reports | High |

| Investment Strategy | Investment Process, Deal Flow Sources, Due Diligence Framework | Medium |

| LP Relations | LP Reports, Capital Call Notices, Distribution Notices | Medium |

| ESG & Impact | ESG Policy, Impact Metrics, Sustainability Reports | Medium |

Detailed breakdown of essential documents

1. Fund overview

These documents provide a comprehensive introduction to your venture fund:

- Fund Presentation: A concise, visually appealing presentation outlining the fund's strategy, team, track record, and value proposition

- Executive Summary: A 2-3 page document summarizing key aspects of the fund

- Investment Thesis: Detailed explanation of your fund's investment philosophy, target sectors, and investment criteria

- Value Creation Strategy: How your fund helps portfolio companies grow and succeed

2. Legal & governance documents

These documents establish the legal framework and governance structure of your fund:

- Limited Partnership Agreement (LPA): The primary legal document governing the fund

- Private Placement Memorandum (PPM): Detailed disclosure document for potential investors

- Subscription Documents: Forms for investors to commit capital to the fund

- Fund Formation Documents: Certificate of formation, registration documents, and other legal filings

- Compliance Policies: Documents outlining regulatory compliance procedures

- Side Letters: Special arrangements with specific LPs (redacted as appropriate)

3. Team information

Showcase the expertise and experience of your investment team:

- Partner Biographies: Detailed backgrounds of managing partners and key team members

- Track Records: Historical investment performance of the team members

- Team Structure: Organizational chart showing roles and responsibilities

- References: Contact information for professional references (with permission)

- Advisory Board: Information about advisors and their contributions to the fund

4. Financial information

Provide transparent insights into the fund's financial performance:

- Fund Performance Metrics: IRR, TVPI, DPI, and other key performance indicators

- Capital Account Statements: Regular updates on each LP's capital account

- Financial Projections: Expected returns and cash flow forecasts

- Management Fee Structure: Details on management fees and carried interest

- Fund Expenses: Breakdown of operational expenses and allocation methodology

- Audited Financial Statements: Annual financial reports verified by independent auditors

| Financial Document | Update Frequency | Access Level |

|---|---|---|

| Fund Performance Dashboard | Quarterly | All LPs |

| Capital Account Statements | Quarterly | LP-Specific |

| Audited Financial Statements | Annually | All LPs |

| Cash Flow Projections | Semi-Annually | All LPs |

| Fund Expense Reports | Quarterly | All LPs |

5. Portfolio companies

Provide detailed information about your fund's investments:

- Portfolio Overview: Summary of all portfolio companies with key metrics

- Investment Memos: Original investment theses for each portfolio company

- Valuation Reports: Current valuations and methodologies used

- Portfolio Company Updates: Regular reports on company performance

- Exit Analyses: Post-mortem analyses of successful exits and failures

- Case Studies: Detailed examples of value creation in select portfolio companies

6. Investment strategy

Explain your fund's approach to identifying and executing investments:

- Investment Process: Step-by-step explanation of how investments are sourced, evaluated, and executed

- Deal Flow Sources: Overview of how the fund sources potential investments

- Due Diligence Framework: Standardized approach to evaluating potential investments

- Investment Committee Memos: Examples of investment committee presentations (anonymized)

- Sector Theses: Detailed analyses of target sectors and market opportunities

- Risk Management Strategy: Approach to mitigating investment and portfolio risks

7. LP relations

Documents related to ongoing communication with limited partners:

- LP Reports: Quarterly and annual reports sent to limited partners

- Capital Call Notices: Templates and examples of capital call communications

- Distribution Notices: Templates and examples of distribution notices

- LP Meeting Materials: Presentations from annual LP meetings

- LPAC Materials: Information shared with the LP Advisory Committee

- FAQ Document: Responses to common LP questions

8. ESG & impact

Demonstrate your fund's commitment to responsible investing:

- ESG Policy: Formal policy on environmental, social, and governance considerations

- Impact Metrics: Framework for measuring social and environmental impact

- Sustainability Reports: Regular updates on ESG performance

- Diversity & Inclusion Initiatives: Policies and progress on D&I within the fund and portfolio

- UN PRI Reporting: Reports submitted to the UN Principles for Responsible Investment

How to organize your venture fund data room

A well-organized data room enhances usability, accessibility, and security. Here are best practices for structuring and securing your venture fund data room:

1. Create a logical folder structure

Organize documents into clear categories following the checklist above. Use consistent naming conventions for all folders and subfolders.

2. Implement version control

Maintain document version history to track changes over time. Include dates in file names for regularly updated documents (e.g., "Q2_2025_LP_Report.pdf").

3. Prepare an index document

Create a master document that explains the data room structure and helps users navigate to specific information quickly.

4. Set appropriate access permissions

Implement granular access controls to ensure sensitive information is only available to authorized users:

| User Type | Access Level | Document Restrictions |

|---|---|---|

| Prospective LPs (Early Stage) | Basic | Fund Overview, Team Information, Redacted Track Record |

| Prospective LPs (Advanced DD) | Standard | Most Documents Except LP-Specific Information |

| Existing LPs | Full | All Documents Including LP-Specific Reports |

| LPAC Members | Extended | All Documents Plus LPAC Materials |

| Fund Auditors | Financial Focus | Financial Documents, Legal Documents |

5. Maintain regular updates

Establish a schedule for updating different categories of documents:

- Quarterly updates for financial information and portfolio company reports

- Annual updates for fund presentations and marketing materials

- Immediate updates for significant events (exits, new investments, key personnel changes)

6. Choose a secure provider

Select a data room provider with robust security features, including:

- End-to-end encryption

- Two-factor authentication

- Detailed access logs

- Watermarking capabilities

- Remote access revocation

7. Implement document protection

Apply appropriate protection to sensitive documents:

- Watermarking with viewer information

- Disabling downloads for highly confidential documents

- Setting document expiration dates

- Preventing screen captures and printing when necessary

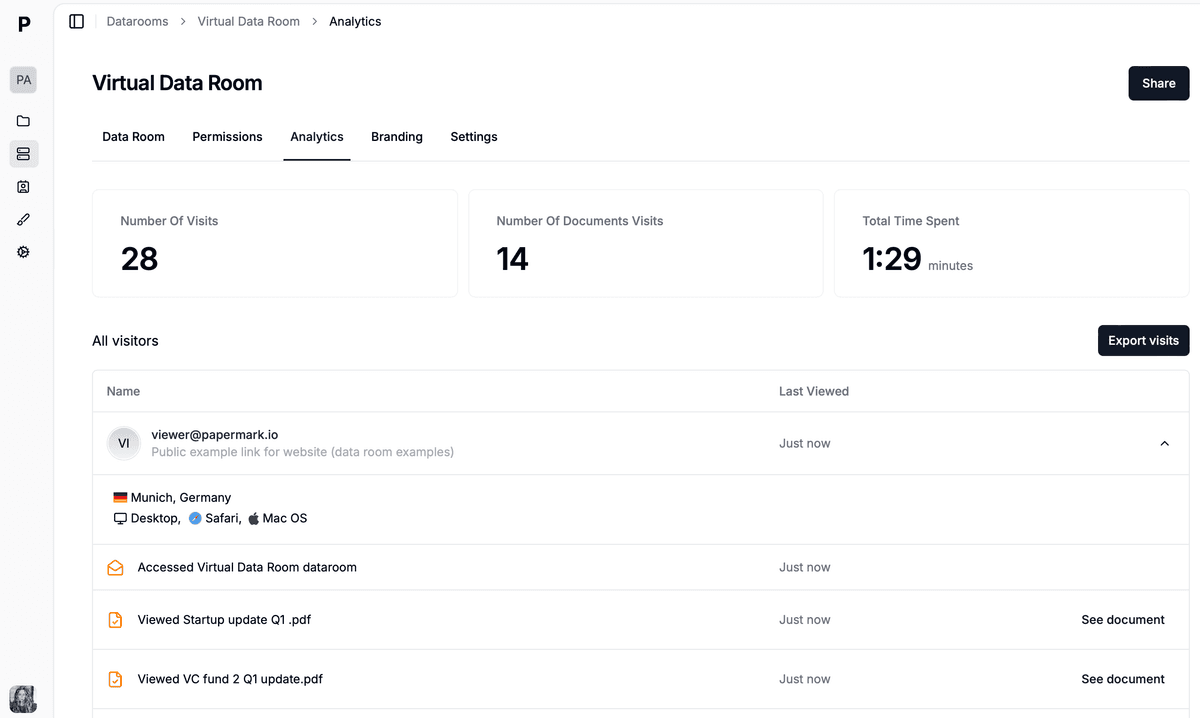

8. Monitor user activity

Track how users interact with your data room:

- Document view analytics

- Time spent on specific documents

- Download activity

- Login patterns

Papermark offers an ideal solution for venture funds with its combination of robust security, comprehensive analytics, and user-friendly interface. The platform's document tracking capabilities provide valuable insights into LP engagement, while customizable access controls ensure sensitive information remains protected.

Venture fund data room checklist template

Use this template to track the completion status of your data room:

| Priority Level | Document Type | Status |

|---|---|---|

| Priority 1 (Must-Have) | Fund Presentation | ⬜ |

| Priority 1 (Must-Have) | Limited Partnership Agreement | ⬜ |

| Priority 1 (Must-Have) | Private Placement Memorandum | ⬜ |

| Priority 1 (Must-Have) | Partner Biographies | ⬜ |

| Priority 1 (Must-Have) | Track Record | ⬜ |

| Priority 1 (Must-Have) | Fund Performance Metrics | ⬜ |

| Priority 1 (Must-Have) | Portfolio Overview | ⬜ |

| Priority 1 (Must-Have) | Investment Thesis | ⬜ |

| Priority 2 (Important) | Subscription Documents | ⬜ |

| Priority 2 (Important) | Team Structure | ⬜ |

| Priority 2 (Important) | Financial Projections | ⬜ |

| Priority 2 (Important) | Investment Process Documentation | ⬜ |

| Priority 2 (Important) | LP Report Examples | ⬜ |

| Priority 2 (Important) | Case Studies | ⬜ |

| Priority 3 (Nice-to-Have) | ESG Policy | ⬜ |

| Priority 3 (Nice-to-Have) | Sector Theses | ⬜ |

| Priority 3 (Nice-to-Have) | LPAC Materials | ⬜ |

| Priority 3 (Nice-to-Have) | Exit Analyses | ⬜ |

| Priority 3 (Nice-to-Have) | Impact Metrics | ⬜ |

💡 Pro Tip: Start with Priority 1 documents and work your way down. Most LPs will initially focus on these core documents during their preliminary evaluation.

How to choose the right data room provider

Unlike email or Google Drive which lack robust security controls and activity tracking, dedicated data room providers offer enterprise-grade protection for your sensitive fund information, preventing unauthorized access, data leaks, and providing detailed analytics on document engagement.

Selecting the appropriate data room provider is crucial for venture funds. Consider these factors:

Key features to look for:

- Security: Advanced encryption and access controls

- Analytics: Detailed document engagement tracking

- Customization: Branding and organization flexibility

- Ease of Use: Intuitive interface for both administrators and users

- Mobile Access: Functionality across devices

- Integration: Compatibility with other tools in your tech stack

Papermark offers an ideal solution for venture funds with its combination of robust security, comprehensive analytics, and user-friendly interface. The platform's document tracking capabilities provide valuable insights into LP engagement, while customizable access controls ensure sensitive information remains protected.

Conclusion

A well-organized venture fund data room is an essential tool for effective LP communication, streamlined due diligence, and professional fund management. By following this comprehensive checklist and implementing best practices for organization and security, your fund can create a data room that enhances credibility with investors and improves operational efficiency.

Remember that your data room is often the first in-depth impression potential LPs will have of your fund's operations. Investing time in creating a thorough, well-structured data room demonstrates your commitment to transparency and operational excellence—qualities that sophisticated limited partners highly value when selecting fund managers.