The 30 Biggest Tech Acquisitions of the Last Decade

30. Twitter Acquires MoPub

- Year: 2013

- Value: $350 million

Twitter's acquisition of MoPub expanded its advertising capabilities by providing better ad monetization tools.

29. Amazon Buys Zappos

- Year: 2009

- Value: $1.2 billion

This acquisition helped Amazon gain a foothold in the online shoe and apparel market.

28. Meta Acquires Instagram

- Year: 2012

- Value: $1 billion

Meta's acquisition of Instagram reshaped the social media landscape, giving it dominance in photo and video sharing.

27. Cisco Acquires ThousandEyes

- Year: 2020

- Value: $1 billion

Cisco acquired ThousandEyes to enhance its network intelligence and analytics capabilities, a move aimed at improving network performance monitoring.

26. eBay Acquires PayPal

- Year: 2002 (Split in 2015, Re-Acquisition in Talks)

- Value: $1.5 billion

Although this deal occurred before the last decade, PayPal's growth under eBay influenced the payments landscape significantly.

25. Meta Acquires Oculus VR

- Year: 2014

- Value: $2 billion

This acquisition underscored Meta's commitment to virtual reality and its vision for the metaverse.

24. Google Buys Fitbit

- Year: 2021

- Value: $2.1 billion

This acquisition marked Google's entry into the wearables market, enhancing its health and fitness technology portfolio.

23. Uber Acquires Postmates

- Year: 2020

- Value: $2.65 billion

This deal strengthened Uber's food delivery business, helping it compete more effectively against DoorDash.

22. Apple Buys Beats Electronics

- Year: 2014

- Value: $3 billion

Apple's acquisition of Beats brought premium headphones and a music streaming service under its umbrella.

21. Google Acquires Nest Labs

- Year: 2014

- Value: $3.2 billion

Google expanded into smart home technology with its acquisition of Nest Labs, known for its innovative thermostats and security devices.

20. HP Acquires Poly

- Year: 2022

- Value: $3.3 billion

HP expanded its portfolio of workplace solutions with this acquisition of the video and audio tech company Poly.

19. Adobe Buys Marketo

- Year: 2018

- Value: $4.75 billion

Adobe expanded its marketing technology offerings with the acquisition of Marketo, targeting enterprise customers.

18. Microsoft Acquires GitHub

- Year: 2018

- Value: $7.5 billion

Microsoft expanded its developer tools portfolio with the acquisition of GitHub, the largest software development platform globally.

17. Amazon Acquires MGM

- Year: 2021

- Value: $8.45 billion

With this acquisition, Amazon gained access to MGM's massive library of content to boost its Prime Video offering.

16. Google Acquires Motorola Mobility

- Year: 2012

- Value: $12.5 billion

This acquisition helped Google secure patents for its Android ecosystem and briefly entered the hardware market.

15. Intel Buys Altera

- Year: 2015

- Value: $16.7 billion

Intel acquired Altera to enhance its data center and FPGA offerings, targeting cloud computing markets.

14. Intel Buys Mobileye

- Year: 2017

- Value: $15.3 billion

This acquisition positioned Intel as a key player in the autonomous driving and computer vision space.

13. Salesforce Buys Tableau

- Year: 2019

- Value: $15.7 billion

Salesforce added advanced data visualization and analytics capabilities with this acquisition.

12. Adobe Acquires Figma

- Year: 2022

- Value: $20 billion

Adobe strengthened its design tools portfolio with this high-profile acquisition, aiming to dominate collaborative design.

11. Microsoft Acquires LinkedIn

- Year: 2016

- Value: $26.2 billion

This acquisition solidified Microsoft's position in professional networking and enterprise tools.

10. Salesforce Acquires Slack

- Year: 2021

- Value: $27.7 billion

This acquisition bolstered Salesforce's position in the collaboration tools market, directly competing with Microsoft Teams.

9. Oracle Acquires Cerner

- Year: 2021

- Value: $28.3 billion

Oracle's acquisition of Cerner marked its expansion into the healthcare IT sector, enhancing its cloud-based solutions for patient care.

8. SoftBank Acquires ARM

- Year: 2016

- Value: $31 billion

SoftBank's acquisition of ARM signaled its interest in IoT and mobile computing technologies.

7. AMD Acquires Xilinx

- Year: 2020

- Value: $35 billion

AMD boosted its semiconductor capabilities with this acquisition, strengthening its competitive edge against Intel.

6. IBM Buys Red Hat

- Year: 2019

- Value: $34 billion

IBM acquired Red Hat to accelerate its hybrid cloud strategy, making this the largest software acquisition of the decade.

5. NVIDIA Acquires ARM

- Year: Pending Approval (Announced 2020)

- Value: $40 billion

This proposed deal aims to combine NVIDIA's expertise in AI with ARM's dominant mobile processing technology.

4. Dell Acquires EMC

- Year: 2016

- Value: $67 billion

This deal remains one of the largest tech acquisitions ever, positioning Dell as a leader in data storage and cloud computing.

3. Microsoft Acquires Activision Blizzard

- Year: 2022

- Value: $68.7 billion

This acquisition marked Microsoft's largest deal ever, emphasizing its commitment to gaming and the metaverse.

2. Oracle Acquires TikTok US Operations (Pending)

- Year: 2021

- Value: $90 billion

Antitrust clearance yet completed impacts scale signifying fiscal landmarks.

1. Dell Acquires EMC

- Year: 2016

- Value: $67 billion

This monumental acquisition highlights the value of high-end data storage solutions.

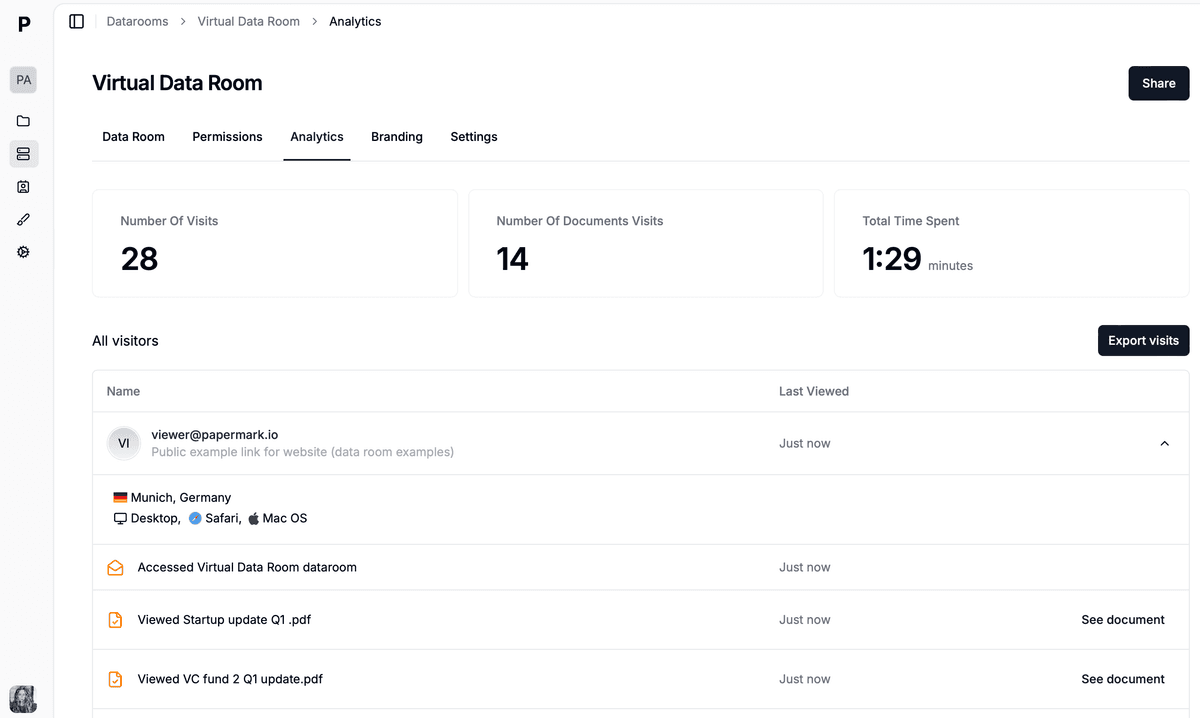

Managing M&A with Secure Data Rooms

When dealing with large-scale tech acquisitions, secure data rooms play a crucial role in facilitating the due diligence process. A virtual data room (VDR) provides a secure environment for sharing sensitive documents and information between parties involved in mergers and acquisitions.

Key Benefits of Data Rooms for M&A

- Secure Document Sharing: Protect sensitive information with advanced encryption and access controls

- Due Diligence Efficiency: Streamline the review process with organized document structure

- Activity Tracking: Monitor who views what and when with detailed analytics

- Cost-Effective: More affordable than traditional physical data rooms

- 24/7 Access: Enable remote access to documents from anywhere

Papermark's Data Room Solution

Papermark offers an ideal solution for managing M&A transactions with its combination of robust security features and user-friendly interface:

- Unlimited data rooms and storage

- Advanced document analytics

- Custom branding options

- Self-hosting capabilities

- Open-source platform

Cost-Effective Solution

Compared to traditional VDR providers, Papermark offers competitive pricing:

- Papermark VDR: €59/month (billed yearly)

- Average VDR providers: €750/month (billed yearly)

Conclusion

A well-organized data room is essential for successful M&A transactions. It ensures secure document sharing, streamlines the due diligence process, and helps maintain confidentiality throughout the deal. With Papermark's secure and affordable solution, you can create a professional data room that facilitates smooth M&A transactions while protecting sensitive information.